Gaji Stuck? Exit Plan RM30k

Diterbitkan pada 13 Okt 2025

18 min baca

Dua Tahun. Gaji Sama.

Kos hidup naik.

Rent naik.

Minyak naik.

Groceries naik.

Tapi gaji?

Gaji masih stuck.

Ini bukan cerita seorang sahaja.

Ini realiti ribuan profesional muda di Kuala Lumpur. Di Penang. Di Johor Bahru.

Bangun pagi. Commute satu jam. Kerja 9 jam. OT tanpa bayaran. Buat kerja dengan dedikasi.

Tunggu performance review.

Dapat 4%.

4%.

Bila inflasi 3%, kos hidup naik 5-6%, apa maksud 4% sebenarnya?

Maksudnya purchasing power tak gerak.

Maksudnya economic stagnation.

Maksudnya loyalty tak dibayar dengan value yang setimpal.

Apa Yang Ada Dalam Guide Ini

Artikel ini bukan motivational speech.

Bukan cerita inspirasi.

Ini battle plan yang actionable.

Bila habis baca, seseorang akan tahu:

Cara calculate exact opportunity cost bila stay vs move (Part 1)

Berapa sebenarnya market bayar untuk skills yang ada (Part 2)

How to build RM12,000-24,000 emergency fund dalam 3-6 bulan (Part 3)

5 high-value skills yang market bayar premium (Part 4)

Legal way untuk shorten notice period tanpa burn bridges (Part 5)

Step-by-step checklist dari bulan 1 hingga successful transition (Part 6)

Bottom line up front:

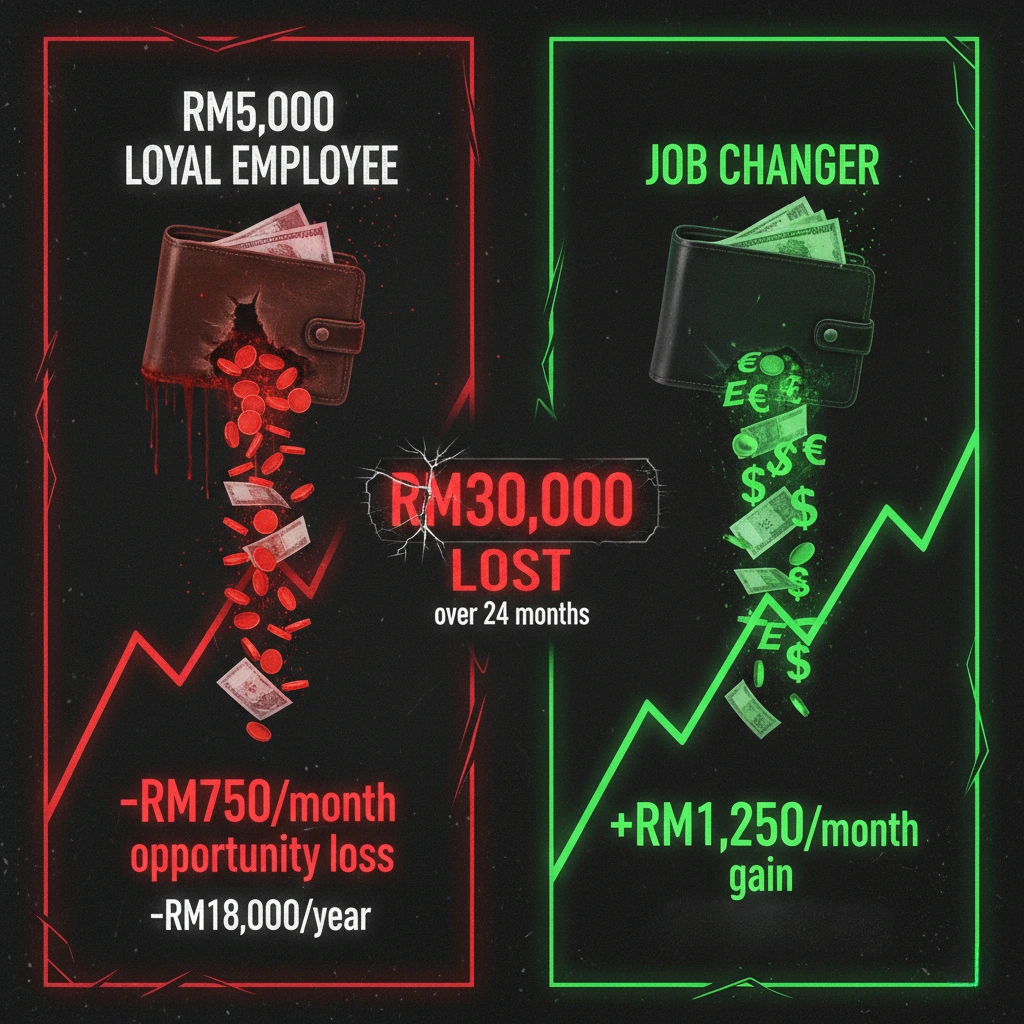

Average internal raise: 4-5%

Average jump via job change: 20-30%

Opportunity cost kalau stay 2 tahun: RM18,000-RM30,000+

Data tak tipu:

49% pekerja Malaysia yang stay di tempat sama dapat kenaikan gaji tak lebih dari 5%.

Ini bukan reward.

Ini survival mode.

Part 1: The Real Cost of Staying

Opportunity Cost Yang Ramai Tak Nampak

Ada satu calculation yang simple tapi powerful.

Namanya: opportunity cost of loyalty.

Scenario A: Stay Loyal

- Gaji sekarang: RM5,000 sebulan

- Annual raise: 5%

- Tambah: RM3,000 setahun

Scenario B: Strategic Move

- Gaji sekarang: RM5,000 sebulan

- Market jump: 20-30%

- Tambah: RM12,000 - RM18,000 setahun

Beza?

RM9,000 hingga RM15,000.

Setahun.

Dalam dua tahun?

RM30,000 kehilangan.

Ini bukan speculation.

Ini market reality.

83% pekerja Malaysia yang tukar kerja sebut higher salary sebagai motivasi utama.

Dan mereka yang berjaya tukar?

Dapat 20-30% salary jump.

Jadi bila seseorang rasa “gaji tak naik dua tahun,” bukan just feeling kosong.

Ia quantifiable financial loss.

Setiap bulan duduk diam, opportunity cost keeps accumulating.

Seperti bleeding financially, slow tapi consistent.

The Loyalty Trap

Ramai percaya kalau stay loyal, company akan appreciate.

Akan nampak dedication.

Akan reward accordingly.

Reality check:

Data menunjukkan 54% pekerja Malaysia rasa compensation mereka tak fair reflect kerja yang buat.

47% rasa responsibilities bertambah tapi gaji tak naik proportionately.

Kenapa?

Sebab dari employer perspective, seseorang yang already settled adalah lowest risk. Tak perlu compete untuk retain. Tak perlu offer market rate.

Steady worker = steady cost.

Tapi bagi yang keluar dan masuk balik market?

New hire = market premium.

Company willing bayar 20-30% lebih untuk attract talent dari outside.

Ini bukan fair.

Tapi ini how system works.

Part 2: What Market Actually Pays

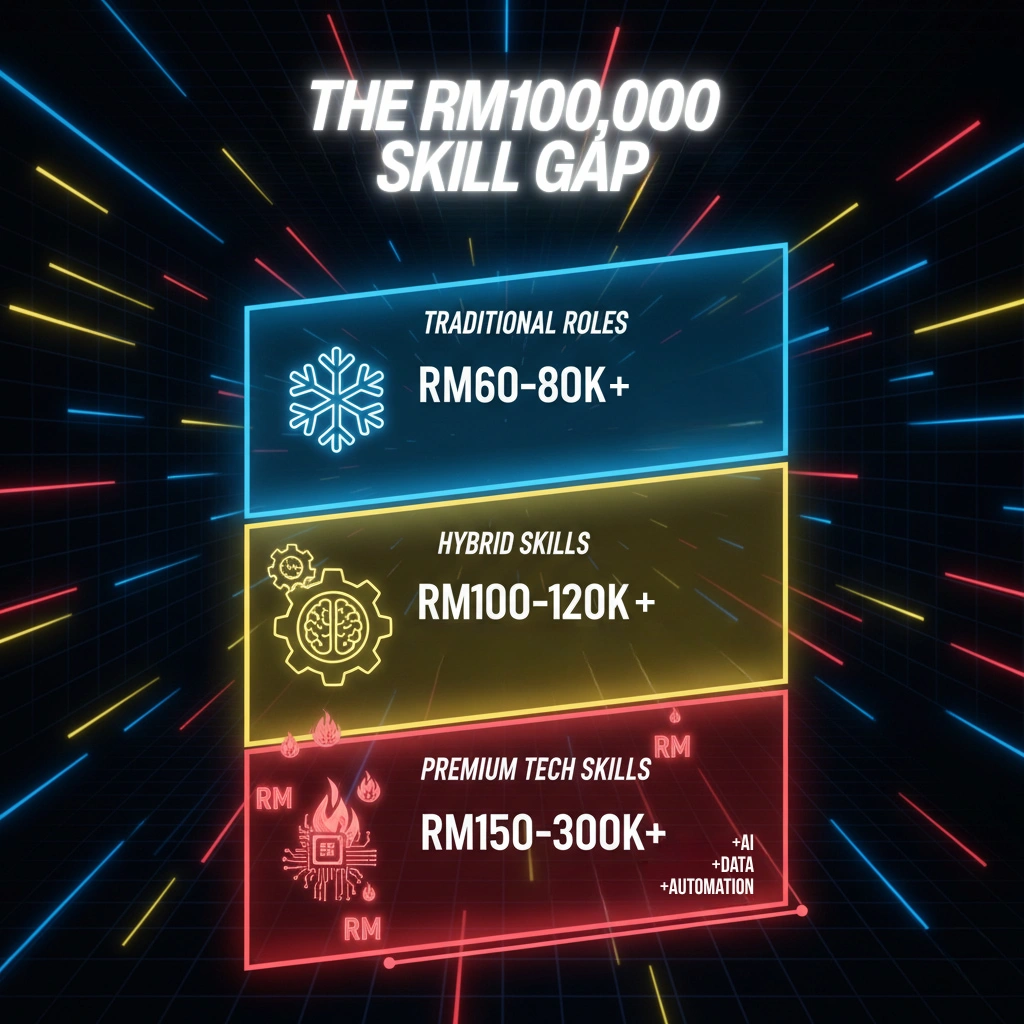

The Two-Track Economy

2025, Malaysia punya labour market menunjukkan split yang clear.

Jelas.

Terang.

Tak boleh ignore.

Track 1: Traditional Roles

Slow growth. Predictable. Safe.

Entry level: RM2,500 - RM3,000

Annual raise: 3-5%

Comfortable tapi tak wealth-building.

Track 2: Digital Economy

High growth. High demand. High pay.

AI specialists: +40-53% salary increase

Cybersecurity: RM120,000 - RM300,000 setahun

Tech skills: Premium pricing.

Lihat contrast:

Tech Sector:

- Junior Software Developer: RM60,000 - RM120,000 setahun

- Data Scientist: RM144,000 - RM240,000 setahun

- Cybersecurity Specialist: RM120,000 - RM300,000 setahun

Finance & Banking:

- Accountant: RM84,000 - RM120,000 setahun

- Financial Analyst: RM84,000 - RM120,000 setahun

Digital Marketing:

- Digital Marketing Manager: RM96,000 - RM156,000 setahun

Apa maksud semua ini?

Market tengah reward certain skills dengan premium yang sangat tinggi.

Dan yang tak upgrade skills?

Stuck.

Tahun demi tahun.

Bracket yang sama.

The Skills Premium

Ini bukan just about tech versus non-tech.

Principle sama across industries.

Pattern yang jelas:

Traditional accountant → Standard pay

Accountant + data analytics skills → Premium pay

Traditional marketer → Average salary

Marketer + AI-driven tools → Higher earning potential

Traditional engineer → Steady income

Engineer + automation expertise → Market premium

Formula simple:

Digital skills + Domain expertise = Multiplied earning potential

Part 3: Build Your Financial Runway

Sekarang critical part.

Sebelum boleh move, kena ada foundation.

Emergency fund bukan luxury.

Ia necessity.

Ia safety net.

Ia confidence booster.

The 3-6 Month Rule

Berapa yang perlu?

Minimum 3-6 bulan basic expenses.

Bukan lifestyle expenses.

Basic survival.

Breakdown Kuala Lumpur:

Sewa (1BR city center) → RM2,000 - RM3,000

Utilities → RM250 - RM600

Internet + Phone → RM170 - RM300

Transport → RM100 - RM150

Groceries → RM800 - RM1,200

Makan luar → RM450 - RM750

TOTAL BASIC → RM3,770 - RM6,000

Calculation simple:

Monthly expenses RM4,000 × 3 bulan = RM12,000 minimum

Monthly expenses RM4,000 × 6 bulan = RM24,000 ideal

The Common Mistake

Ramai fikir:

“Nak resign esok. Cari kerja lepas resign.”

Tanpa safety net.

Tanpa backup.

Apa jadi?

Week 1-2: Optimistic. Confident.

Week 3-4: Mulai worry.

Week 5-6: Bills datang. Pressure build.

Week 7-8: Panic mode.

Bila dah panic, apa decision dibuat?

Ambil any job yang dapat.

Even if tak better dari sekarang.

Even if lateral move.

Even if toxic environment.

Sebab bills need to pay.

Sebab rent due.

Sebab savings dah depleted.

Ini bukan strategy.

Ini desperation.

EPF Akaun Fleksibel: Game Changer

2024 bawa satu tool yang powerful.

EPF restructure. Introduce Akaun Fleksibel (Account 3).

Setiap bulan 10% contribution masuk sini.

Rules straightforward:

✓ Boleh withdraw anytime

✓ Boleh withdraw any amount

✓ Minimum RM50

✓ No restrictions on usage

✓ Apply through i-Akaun app

Maksudnya?

Ada legitimate fallback yang accessible bila perlu.

Legal.

Easy.

Fast.

Tapi dengar baik-baik:

EPF bukan first line of defense.

Emergency fund yang properly saved tu first.

EPF adalah backup to your backup.

Last resort bila situation truly critical.

Sebab withdraw from EPF means sacrificing retirement funds.

Future security untuk immediate needs.

Better ada dedicated emergency fund yang boleh guna guilt-free.

Ramai Tanya: Kalau Tak Cukup Savings Macam Mana?

Bila target emergency fund macam RM12,000-24,000, ramai rasa overwhelmed.

“Macam mana nak save banyak tu?”

Strategy bukan save sekaligus.

Strategy adalah consistent small steps.

Breakdown realistic:

Target: RM12,000 dalam 6 bulan

Per month: RM2,000

Per week: RM500

Per day: RM70-80

Cara accelerate:

Cut subscription services yang jarang guna → Save RM200-300/month

Reduce makan luar dari 5x ke 2x seminggu → Save RM400-600/month

Defer major purchases (gadgets, fashion) → Save RM500-1,000/month

Freelance side projects on weekend → Earn extra RM800-1,500/month

Combine semua?

Boleh hit RM2,000/month saving rate.

Dalam 6 bulan, emergency fund ready.

Part 4: The Skills Currency

Sekarang bahagian paling powerful.

Skills = Real currency dalam ekonomi hari ini.

Market bukan lagi tentang kerja keras sahaja.

Ia tentang right skills.

Ada professionals kerja 10 jam sehari.

Gaji stuck.

Kenapa?

Skillset outdated.

Ada professionals kerja 8 jam sehari.

Dibayar triple.

Kenapa?

Skills yang market desperately need.

Difference bukan effort.

Difference adalah relevance.

High-Value Skills 2025

- Artificial Intelligence & Machine Learning

Market growth: 28-32% annually

Skills needed:

- Python

- TensorFlow

- Natural Language Processing

- Computer Vision

Salary impact: +40-53%

- Cloud Computing

Platforms:

- AWS

- Azure

- Google Cloud

Focus areas:

- Multi-cloud architecture

- Infrastructure-as-Code

Market demand: Critical shortage

- Cybersecurity

Malaysia perlu 25,000 cybersecurity professionals.

Sekarang?

Shortage teruk.

Skills:

- Threat analysis

- Penetration testing

- Security coding

Salary range: RM120,000 - RM300,000

- Data Science & Analytics

Tools:

- SQL

- Python

- Tableau

- Power BI

Application: Data-driven decision making

Demand: High across ALL sectors

- Digital Marketing

Modern approach:

- AI-driven campaigns

- SEO + Performance Marketing

- Content strategy + Analytics

Market need: Growing exponentially

The Investment Mindset

Bila seseorang invest masa untuk learn these skills, bukan sekadar add nice-to-have di resume.

Ia literally multiply earning potential.

Real talk:

Tak semua orang nak jadi programmer.

Understood.

Tapi principle sama across industries:

Digital marketing professional + AI tools = Higher pay

Engineer + Automation knowledge = Premium compensation

Accountant + Data analytics = Increased value

HR professional + People analytics = Market advantage

Pattern jelas:

Traditional skill + Digital capability = Market premium

Bila Orang Cakap “Takde Masa Nak Belajar”

Ini most common objection.

“Kerja dah full time, macam mana nak belajar lagi?”

Reality check:

Orang yang berjaya upskill bukan ada 30 jam sehari.

Mereka ada 24 jam macam semua orang.

Difference adalah priority dan strategy.

Time allocation realistic:

5-7 jam seminggu untuk learning.

Breakdown:

- Weekday nights: 1 jam × 3 days = 3 jam

- Weekend morning: 2-4 jam

Dalam 3 bulan:

5 jam/week × 12 weeks = 60 jam invested

Cukup untuk complete solid online course + build 1-2 portfolio projects.

Dalam 6 bulan:

120 jam invested

Cukup untuk earn certification + build strong portfolio + start applying skills at work.

Sacrifice apa?

Netflix time.

Social media scrolling.

Lepak tanpa purpose.

Trade 5-7 jam entertainment untuk skill yang boleh increase earning RM12,000-30,000 setahun?

ROI calculation jelas.

How To Actually Learn

Strategy simple:

Step 1: Identify 1-2 high-value skills relevant to industry

Step 2: Find quality online course

- Coursera

- Udemy

- LinkedIn Learning

- Platform lain yang credible

Step 3: Dedicate 5-7 jam seminggu

- Schedule dalam calendar

- Treat like important meeting

- Non-negotiable commitment

Step 4: Build practical project untuk portfolio

- Bukan just theory

- Real application

- Something tangible to show

Step 5: Get certification if possible

- Add credibility

- Structured learning path

- Recognized credential

Step 6: Update LinkedIn + Resume

- Showcase new skills

- Link to projects

- Demonstrate capability

Dalam 3-4 bulan, ada tangible skill upgrade.

Dalam 6 bulan, ada certification + portfolio.

Ini game changer.

Part 5: Execute The Exit Professionally

Dah ada emergency fund. ✓

Dah upgrade skills. ✓

Sekarang nak execute dengan betul.

Timing Is Everything

Mistake #1: Resign Before Bonus

Ini paling common.

Dapat offer baru. Excited.

Submit resignation immediately.

Lupa apa?

Bonus payout next month.

Potentially RM5,000 - RM15,000.

Check employment contract:

Banyak company require employees “employed on bonus payout date” untuk qualify.

Miss by one day?

Lose entire bonus.

Strategy:

Tunggu bonus masuk bank account dulu.

Baru submit resignation letter.

Extra 2-4 minggu waiting worth thousands of ringgit.

Mistake #2: Resign Mid-Critical Project

Timing affect reputation.

Resign tengah-tengah critical phase?

Team scramble.

Chaos.

Negative last impression.

Better timing:

Lepas major project completed.

Deliverables submitted.

Documentation done.

Team can breathe.

Benefits:

✓ Smooth handover

✓ Positive lasting impression

✓ Better reference quality

✓ Professional brand intact

Mistake #3: Ignore Performance Review Timing

Kalau just dapat excellent review, ini good leverage point.

Ada documented evidence of strong performance.

Helps dengan:

- Resignation conversation

- Reference requests

- Future background checks

- LinkedIn recommendations

Know The Legal Framework

Employment Act 1955 set minimum notice periods:

Less than 2 years service → 4 weeks notice

2 to 5 years service → 6 weeks notice

5 years and above → 8 weeks notice

TAPI:

Employment contract overrides law (kalau better atau equal).

Check contract first.

Shorten Notice Period: Legal Options

Option 1: Negotiate

Approach boss atau HR.

Explain situation professionally.

Present solid handover plan.

“I have another opportunity that requires earlier start date. However, I’ve prepared comprehensive documentation and willing to do knowledge transfer sessions. Can we discuss?”

Success rate?

Depends on relationship + workload + replacement availability.

Worth trying.

Option 2: Use Annual Leave

Apply unutilized leave untuk offset working days.

Example:

- 6 weeks notice required

- 10 days annual leave available

- Work only 4 weeks, leave cover rest

Note: Employer boleh refuse dan choose to pay out leave instead.

Option 3: Payment In Lieu

Bayar equivalent salary untuk notice period yang tak serve.

Example:

- 4 weeks notice

- Monthly salary RM5,000

- Payment: RM5,000 untuk immediate release

Ini legal right.

Tapi last resort.

Expensive.

Ada Yang Tanya: Boleh Ke Tarik Balik Resignation?

Situasi: Submit resignation, lepas tu dapat counter-offer yang good.

Atau new job offer fall through.

Boleh cancel resignation ke?

Legally:

Kalau employer agree, boleh.

Resignation adalah mutual agreement untuk end employment.

Kalau both parties setuju continue, no legal barrier.

Practically:

Complicated.

Once resign, relationship dynamic dah changed.

Trust affected.

Management might view as flight risk.

Nasihat:

Only resign bila dah 100% committed to move.

Jangan guna resignation sebagai negotiation tactic.

High risk, potential backfire.

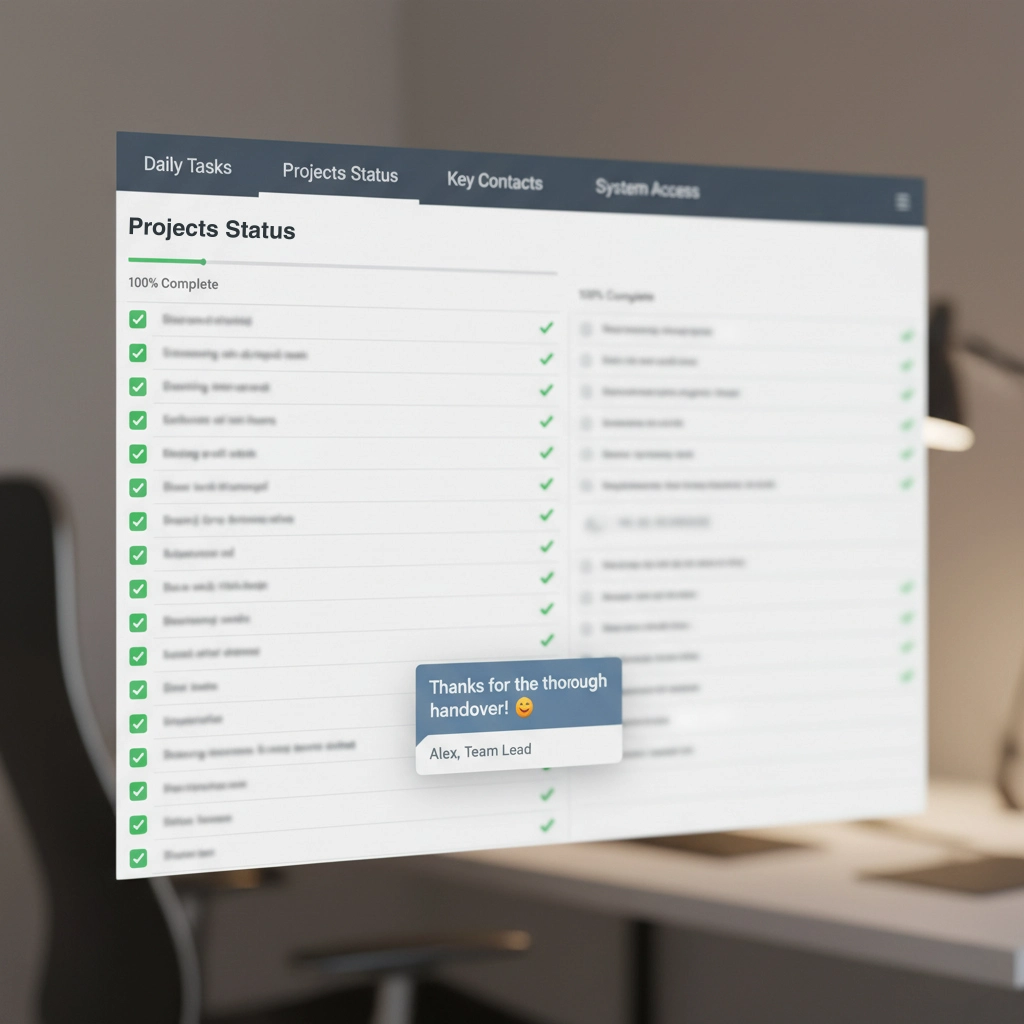

Part 6: Professional Handover

Ini bahagian yang ramai underestimate.

Big mistake.

Malaysia professional community small.

Very small.

Today resign dari Company A.

Next year ex-boss jadi potential client.

Atau ex-colleague jadi hiring manager tempat nak apply.

Professional reputation adalah long-term asset.

Jaga baik-baik.

Handover Document Must-Haves

- Complete Responsibilities List

Daily tasks:

- Opening rituals

- System checks

- Email management

- Regular updates

Weekly tasks:

- Reports

- Meetings

- Reviews

- Follow-ups

Monthly tasks:

- Closing procedures

- Analytics

- Planning

- Stakeholder updates

- Ongoing Projects Status

For EACH project:

- Current stage

- Next milestones

- Key contacts

- Potential risks

- Required actions

- Deadlines

- Dependencies

- Critical Contacts

Internal:

- Department heads

- Collaborating teams

- Support functions

- Decision makers

External:

- Clients (active)

- Vendors

- Partners

- Service providers

Include:

- Name + Position

- Contact details

- Relationship context

- Communication preferences

- Important notes

- Systems & Tools

List ALL:

- Software used

- Access credentials (safely shared)

- File locations

- Shared drives navigation

- Special procedures

- Troubleshooting guides

- Pending Items

- Awaiting approval

- Needs follow-up

- Deadlines approaching

- Unresolved issues

- Documentation needed

Handover Best Practices

Start Early

Day 1 of notice period = Day 1 of documentation.

Bukan last week baru panic.

Keep It Accessible

Store everything di team shared location.

Not personal drive.

Not personal email.

Central repository yang semua boleh access.

Schedule Transition Meetings

Minimum 2 formal sessions:

Session 1: Overview + Q&A (Week 1-2)

Session 2: Deep dive + clarifications (Week 3-4)

Use Checklist

Create master checklist.

Tick off one by one:

□ Documentation completed

□ Files organized + transferred

□ Access shared

□ Contacts introduced

□ Meetings scheduled

□ Company assets returned

□ Systems access revoked

□ Email auto-reply set

Set Auto-Reply

Last working day, activate:

“Thank you for your email. I am no longer with [Company Name] as of [Date]. For matters related to [Your Role], please contact [Replacement Name] at [Email]. For urgent matters, please reach out to [Backup Contact].”

The Farewell

Last day bukan just walk out.

Thank people personally:

- Direct supervisor

- Mentors

- Close colleagues

- Support teams

Request LinkedIn recommendations before leaving.

Easier while relationship fresh.

Better quality.

Leave contact info dengan key people.

Maintain professional relationship.

Network adalah career currency.

Part 7: Complete Exit Strategy Checklist

Phase 1: ASSESSMENT (Month 1-2)

Financial Reality Check

□ Calculate exact monthly basic expenses

□ List ALL debt obligations

□ Assess current savings vs 3-6 month target

□ Check EPF Akaun Fleksibel balance

□ Review credit card limits (emergency backup)

Market Value Analysis

□ Research industry salary benchmarks untuk current role

□ Calculate personal opportunity cost

- Current raise: _____%

- Market average jump: _____%

- Annual difference: RM_____

□ Identify 3-5 target companies in preferred industry

□ Compare total compensation package vs market

□ List 3-5 specific job titles to target

Skills Gap Audit

□ List current skills (technical + soft)

□ Research most in-demand skills in target roles

□ Identify 2-3 high-value skills to acquire

□ Find available courses/certifications

□ Budget for learning investment (if needed)

Phase 2: BUILD FOUNDATION (Month 2-4)

Financial Fortress

□ Open dedicated emergency fund account

(High-interest savings, separate from daily banking)

□ Set up automatic monthly transfers

Target: RM_____ per month

□ Audit current expenses:

- Cut non-essential subscriptions

- Reduce lifestyle spending

- Minimize dining out

- Defer major purchases

□ Reach minimum 3-month emergency fund goal

Target: RM_____

□ Continue toward 6-month ideal target

Target: RM_____

Skills Investment

□ Enroll in relevant course/certification

□ Dedicate 5-7 jam per week to learning

□ Complete at least 1 certification in target skill

□ Build portfolio/practical projects:

- Project 1: _____

- Project 2: _____

- Project 3: _____

□ Document learning journey (LinkedIn posts/articles)

Digital Presence Upgrade

□ LinkedIn profile optimization:

- Professional photo updated

- Headline with high-demand keywords

- About section tells compelling story

- Experience section uses action verbs + quantified results

- Skills section prioritizes in-demand skills

- Recommendations requested (minimum 3)

□ Resume optimization:

- ATS-friendly format

- Keyword-rich for target roles

- Quantified achievements highlighted

- Modern design (not outdated templates)

- Error-free (grammar + spelling checked)

□ Join relevant professional groups:

- LinkedIn groups: _____

- Facebook groups: _____

- Industry forums: _____

□ Start engaging with industry content regularly

Phase 3: STRATEGIC POSITIONING (Month 4-6)

Market Intelligence

□ Monitor job postings at target companies

Set alerts on:

- JobStreet

- Hiredly

- Company career pages

□ Research company cultures:

- Read Glassdoor reviews

- Check social media presence

- Research recent news/funding

- Understand company values

□ Identify salary ranges for target positions

Sources:

- Robert Walters Salary Guide

- Hays Salary Guide

- Michael Page Salary Guide

- Randstad Market Outlook

□ Build referral connection list:

- Ex-colleagues at target companies: _____

- Alumni network: _____

- Professional contacts: _____

Network Activation

□ Reconnect with dormant contacts: Message template ready Genuine interest, not transactional

□ Reach out strategically:

- Ex-colleagues in target companies (minimum 5)

- Industry leaders for advice (minimum 2)

- Recruiters specializing in field (minimum 3)

□ Attend events:

- Industry webinars

- Networking sessions

- Professional meetups

- Online conferences

□ Informational interviews: Schedule with 3-5 people in target roles

Application Preparation

□ Prepare resume versions:

- Version A: _____focused

- Version B: _____focused

- Version C: _____focused

□ Draft cover letter template

Customizable for different companies

□ Prepare interview answers:

- “Tell me about yourself”

- “Why leaving current role?”

- “Why this company?”

- “Salary expectations?”

- “Biggest achievement?”

- “Biggest challenge overcome?”

- Prepare STAR format examples (minimum 5)

□ Technical prep (if relevant):

- Coding challenges practice

- Case study preparation

- Portfolio review ready

Phase 4: EXECUTION (Month 6-8)

Active Job Search

□ Apply consistently: Target: 5-10 quality applications per week

□ Track applications with spreadsheet:

- Company name

- Position

- Date applied

- Follow-up date

- Interview stages

- Status

□ Follow-up strategy:

- After 1 week: Polite check-in

- After 2 weeks: Additional value add

□ Interview preparation:

- Research company thoroughly (1-2 hours)

- Prepare company-specific questions (5-7 questions)

- Mock interview practice (minimum 2 sessions)

- Prepare questions to ask interviewer

□ Post-interview: Send thank-you email within 24 hours

Offer Evaluation

□ Compare offers side-by-side

Create comparison dengan:

- Base salary

- Bonus structure

- EPF contribution

- Medical coverage

- Annual leave

- Career growth potential

- Company culture fit

- Commute time

□ Salary negotiation:

- Know your market value range

- Prepare justification with data

- Practice negotiation script

- Aim for top 25% of range

- Don’t accept first offer immediately

□ Benefits review:

- Medical (coverage limits, family included?)

- Insurance (life, critical illness)

- Leave entitlement (annual, medical, emergency)

- Training budget

- Flexible work arrangements

- Performance bonus structure

□ Get everything in writing: Official offer letter with ALL terms

Resignation Timing Strategy

□ Bonus consideration:

Current bonus payout date: _____

Amount at stake: RM_____

Strategy: Wait until deposited OR negotiate with new employer

□ Project timeline check: Current critical projects:

- Project: _____ | End date: _____

- Project: _____ | End date: _____

Ideal resignation timing: _____

□ Performance review:

Last review date: _____

Next review date: _____

Strategy: Leverage if recent + positive

□ Personal circumstances:

- Any major commitments? _____

- Family considerations? _____

- Financial obligations due? _____

Phase 5: PROFESSIONAL EXIT (Final 4-8 Weeks)

Official Process

□ Prepare resignation letter:

- Professional tone

- Clear last working date

- Gratitude expressed

- Transition support offered

- Kept brief (3-4 paragraphs max)

□ Schedule resignation meeting: Book time with direct supervisor first In-person atau video call (not email/text)

□ Submit official resignation:

- Hand original letter

- Email copy for record

- CC HR department

□ Confirm details with HR:

- Official notice period: _____ weeks

- Last working day: _____

- Final paycheck date: _____

- Benefits end date: _____

- EPF final contribution: _____

- Tax clearance process: _____

□ Schedule exit interview:

Prepare constructive feedback

Keep professional, not emotional

□ Return company property:

- Laptop

- Phone

- Access cards

- Company documents

- Any other assets

Handover Excellence

□ Create handover document (Day 1 of notice):

- Core responsibilities list

- Ongoing projects status

- Critical contacts

- System access info

- Pending items

- FAQs anticipated

□ Organize digital files:

- Move to shared team location

- Clear folder structure

- Delete personal files

- Update file naming conventions

□ Schedule handover meetings:

- Week 1: Overview session dengan successor/team

- Week 2: Deep dive on complex items

- Week 3: Q&A + clarifications

- Week 4: Final check-in

□ Knowledge transfer:

- Document SOPs for recurring tasks

- Record video walkthroughs for complex processes

- Create contact cheat sheet

- Share best practices learned

□ Email handover:

- Set auto-reply for last day

- Forward critical threads

- Update email signature with transition info

Relationship Maintenance

□ Personal thank-yous:

- Direct supervisor (in-person meeting)

- Mentor (coffee/lunch if possible)

- Close colleagues (personal note)

- Support teams (group thank-you)

□ Request recommendations: Before last day, ask for LinkedIn recommendations dari:

- Direct supervisor

- Key colleagues (3-5)

- Cross-functional partners (2-3)

Provide guidance points to make easy for them

□ Update contact info: Share personal email + phone dengan:

- Key professional contacts

- Mentors

- Collaborative partners

- Industry connections

□ LinkedIn updates:

- Update current position to new role

- Keep previous role accurately documented

- Post professional farewell (optional, if appropriate)

- Connect with colleagues want to stay in touch

□ Stay gracious:

Even if leaving due to negative reasons, maintain professional demeanor

Industry small, paths akan cross again

The Reality Check

Sampai sini, ramai akan fikir:

“Wah, banyaknya steps.”

“Complicated gila.”

“Lambat sangat process.”

Real talk:

Ya, banyak steps.

Ya, perlu time commitment.

Ya, perlu discipline.

Tapi soalan lebih penting:

Apa cost of NOT doing all this?

Cost of staying stuck dalam dead-end job dengan gaji stagnant untuk next 5 tahun?

Cost of missing out RM50,000 - RM100,000+ dalam potential earnings?

Cost of professional skills becoming outdated dan irrelevant?

Cost of financial stress yang compound setiap bulan?

Yang complicated:

Strategic exit dengan proper planning.

6-8 bulan preparation.

Professional execution.

Yang lebih complicated:

Financial struggle for years.

Regret about opportunities missed.

Catch up later in career bila dah terlambat.

The Compound Effect

Ramai tak realize long-term impact of strategic moves.

Professional A: The Loyal Stayer

Year 1: RM5,000 × 12 = RM60,000

Year 2: 5% raise = RM63,000

Year 3: 5% raise = RM66,150

Year 4: 5% raise = RM69,458

Year 5: 5% raise = RM72,930

5-Year Total: RM331,538

Professional B: The Strategic Mover

Year 1: RM5,000 × 12 = RM60,000

Year 2: Stay + upskill

Year 3: Move (+25%) = RM75,000

Year 4: Stabilize + upskill

Year 5: Move (+20%) = RM90,000

5-Year Total: RM380,000+

Difference: RM50,000+

Plus Professional B sekarang earning RM90,000 vs RM72,930.

That’s RM17,000+ more per year going forward.

Compounded over 10, 15, 20 tahun?

Ratusan ribu ringgit difference.

Dan ini just financial.

Belum kira:

- Better career trajectory

- Stronger professional network

- More diverse experience

- Enhanced skills portfolio

- Greater market options

- Higher negotiation power

The Permission Slip

Ramai young professionals tunggu permission untuk move.

Permission dari boss.

Permission dari parents.

Permission dari society.

Ini permission slip:

Kalau gaji dah stuck dua tahun.

Kalau opportunities for growth tak ada.

Kalau skills tak develop.

Kalau financial situation makin tight.

You have permission to strategically exit.

Bukan about disloyalty.

Bukan about instability.

Bukan about being ungrateful.

Ini about:

Taking ownership of career trajectory.

Making rational economic decisions.

Investing in long-term professional growth.

Building financial security.

Employers yang truly value talent akan fight untuk retain dengan meaningful compensation.

Yang tak willing?

Market banyak lagi yang appreciate skills dan ready bayar proper value.

The Starting Point

Sekarang, exact steps untuk start:

This Week:

□ Calculate current monthly expenses

□ Check EPF Akaun Fleksibel balance

□ Identify 1 high-value skill to learn

□ Update LinkedIn headline

□ Research 3 target companies

This Month:

□ Open emergency fund account

□ Start automatic savings (minimum RM500/month)

□ Enroll in online course

□ Apply to 3 positions (practice)

□ Request informational interview (1 person)

Next 3 Months:

□ Build RM6,000 - RM12,000 emergency fund

□ Complete 1 certification

□ Apply consistently (5-10 per week)

□ Network actively

□ Interview confidently

Next 6 Months:

□ Secure offer with 20%+ increase

□ Plan strategic resignation timing

□ Execute professional handover

□ Transition smoothly

Resources & Next Steps

Salary Research Tools

Malaysia Salary Guides (Updated 2025):

Robert Walters Malaysia Salary Guide → Comprehensive across industries

Hays Asia Salary Guide → Strong tech & banking data

Michael Page Malaysia Salary Guide → Professional services focus

Randstad Market Outlook & Salary Survey → Market trends analysis

Guna untuk benchmark current salary dan set negotiation targets.

Learning Platforms

For Technical Skills:

Coursera → University-backed courses + certification

Udemy → Practical, project-based learning

LinkedIn Learning → Professional development

FreeCodeCamp → Coding - free resource

For Professional Skills:

Google Digital Garage → Digital Marketing - free

HubSpot Academy → Inbound Marketing - free certification

Tableau Public → Data Visualization - free learning

Job Search Platforms

Malaysia-Specific:

JobStreet Malaysia → Largest database

Hiredly → Tech-focused

LinkedIn Jobs → Professional network integration

Glassdoor Malaysia → Salary insights + company reviews

Industry-Specific Recruiters:

Robert Walters → Professional services, Finance, Tech

Michael Page → Multi-industry

Hays → Banking, Tech, Engineering

Financial Planning Support

Emergency Fund Tools:

CIMB FastSaver → High-interest savings

Maybank SaveUp Account → Goal-based saving

Hong Leong Bank → Compare multiple options

EPF Resources:

KWSP i-Akaun → Official EPF portal

EPF Member Services → 03-8922 6000

EPF Akaun Fleksibel withdrawal guide → Online application process

Debt Management:

AKPK (Agensi Kaunseling dan Pengurusan Kredit) → Free financial counseling → Debt restructuring assistance → Website: www.akpk.org.my

Legal Information

Employment Law Resources:

Employment Act 1955 → Full text available at Attorney General’s Chambers website

Malaysian Bar Council → Employment Law guides

MOHR (Ministry of Human Resources) portal → Worker rights information

Untuk clarify notice period, resignation rights, dan final salary entitlements.

Professional Development

Networking Groups:

LinkedIn Professional Groups → Search by industry

Malaysian Young Professionals networks → City-specific communities

Industry-specific associations → Depends on field

Career Coaching:

Career coaches specializing in Malaysia market → Resume review services → Interview preparation coaching

Note: Invest dalam professional development kalau ROI clear (better job = higher salary).

Final Word

Ekonomi hari ini tidak reward loyalty blindly.

Ia reward strategic career management.

Ia reward continuous skill development.

Ia reward calculated professional moves.

Someone yang blindly stay hoping untuk recognition akan left behind.

Someone yang strategically invest in growth, build safety net, dan move with purpose – they thrive.

Gaji tak naik dua tahun bukan curse.

Ia wake-up call.

Signal untuk assess.

Signal untuk prepare.

Signal untuk strategize.

Signal untuk execute.

Market ada opportunities.

Skills boleh learned.

Financial foundation boleh built.

Professional exit boleh executed with grace.

Question bukan “Should I stay atau should I go?”

Question sebenarnya:

“Am I making strategic decisions about my career, atau letting circumstances decide for me?”

Choose strategy.

Choose preparation.

Choose action.

Sebab dalam ekonomi hari ini:

Strategic mobility bukan risk.

Staying stagnant – that’s the real risk.

Exit strategy checklist saved. Professional future secured. Power dalam your hands.

Disclaimer

Artikel ini adalah educational content sahaja.

Untuk informational purposes.

Bukan professional advice:

Ini bukan legal advice.

Ini bukan financial advice.

Ini bukan career counseling advice.

Setiap situasi berbeza:

Employment contracts berbeza.

Personal circumstances berbeza.

Financial situation berbeza.

Company policies berbeza.

Sebelum buat keputusan besar:

Consult dengan qualified professionals:

- Employment lawyer untuk legal matters

- Licensed financial advisor untuk financial planning

- Certified career coach untuk career strategy

Review your specific:

- Employment contract terms

- Company policies

- Personal financial situation

- Legal obligations

Data dan salary ranges dalam artikel ini adalah based on public salary surveys dan market reports yang available pada 2025. Actual figures boleh berbeza based on individual circumstances, industry, company size, location, dan experience level.

Gunakan artikel ini sebagai starting point untuk journey anda.

Setiap orang punya situation yang unique.

Combine insights dari sini dengan professional guidance untuk make decisions yang best fit your circumstances.

Your career. Your choice. Your strategy.