RM21 or RM33/Hour?

Diterbitkan pada 26 Okt 2025

6 min baca

RM21 vs RM33 Sejam. Kerja Yang Sama. Gaji Yang Sama.

Bezanya? Lokasi.

Seorang junior tech professional di KL. Gaji RM6,000.

Office mode: True hourly rate RM21.49

WFH mode: True hourly rate RM33.61

Difference: 56%

Ini bukan teori. Ini matematik. Mari kira berapa sebenarnya kos untuk hadir di office setiap hari.

The Commuter Tax: Cukai Yang Tersembunyi

Setiap hari pergi office, ada “tax” yang tak nampak pada payslip. Tapi keluar dari poket. Setiap bulan.

Commuter Tax.

🚗 Driving: The Expensive Choice

Petrol costs (RON95 @ RM2.60/L):

| Bandar | Jarak Harian | Kos Bulanan |

|---|---|---|

| KL | 50km | RM229 |

| Penang | 30km | RM137 |

| Johor | 40km | RM183 |

Tapi yang killer? Parking.

| Lokasi | Kos Bulanan |

|---|---|

| KL CBD | RM300 |

| Penang | RM150 |

| Johor CBD | RM280 |

Total KL driver: RM529/bulan

Dan traffic jam? Average KL commuter: 135 minit sehari dalam traffic.

Alasan “drive lagi cepat”? Data kata lain.

🚌 Public Transport: Murah, Tapi…

Monthly pass rates:

| Bandar | Pas | Kos |

|---|---|---|

| KL | My50 | RM50 (unlimited LRT/MRT/bas) |

| Penang | Pas Mutiara | RM10 one-time, lepas tu FREE |

| Johor | myBAS50 | RM50 |

Kos rendah. Ini benar.

Tapi masa?

| Bandar | Masa Commute Harian |

|---|---|

| KL | 2-3 jam |

| Penang | 1.5-2 jam |

| Johor | 1.5 jam |

55 jam sebulan untuk KL commuters. Itu 13.75 hari kerja hilang.

Setahun? 27.5 hari. Hampir sebulan penuh.

🚕 Grab Daily? Jangan Harap

KL, 25km one-way trip:

Base + distance + time = RM34 satu trip

| Tempoh | Kos |

|---|---|

| Return daily | RM70 |

| Monthly | RM1,500+ |

Only untuk emergency. Bukan daily solution.

Office Life: The Hidden Drain

Sampai office bukan bermakna expenses habis. Baru bermula.

🍽️ Food & Social Tax

Lunch:

- Hawker minimum: RM8-15

- Realistic cafe/restoran: RM15-30

- Average: RM15/hari = RM330/bulan

Coffee culture:

- Specialty coffee: RM10/cup

- 3x seminggu: RM120/bulan

- Daily habit: RM220/bulan

Ini bukan just makan minum. Ini “social tax” untuk:

- Team lunch participation

- Coffee break networking

- Office culture integration

Decline? Risk social isolation.

WFH? Cook sendiri RM7-15/meal. Buat kopi sendiri. Zero social pressure.

👔 Professional Wardrobe

Office attire bukan free.

Retail basics:

- Nichii workwear: RM70-140/piece

Annual budget realistic:

- RM600-1,200/year = RM50-100/bulan

Custom/premium tier:

- RM200+/bulan

WFH? Comfortable clothes. Repeat outfit okay. No judgment.

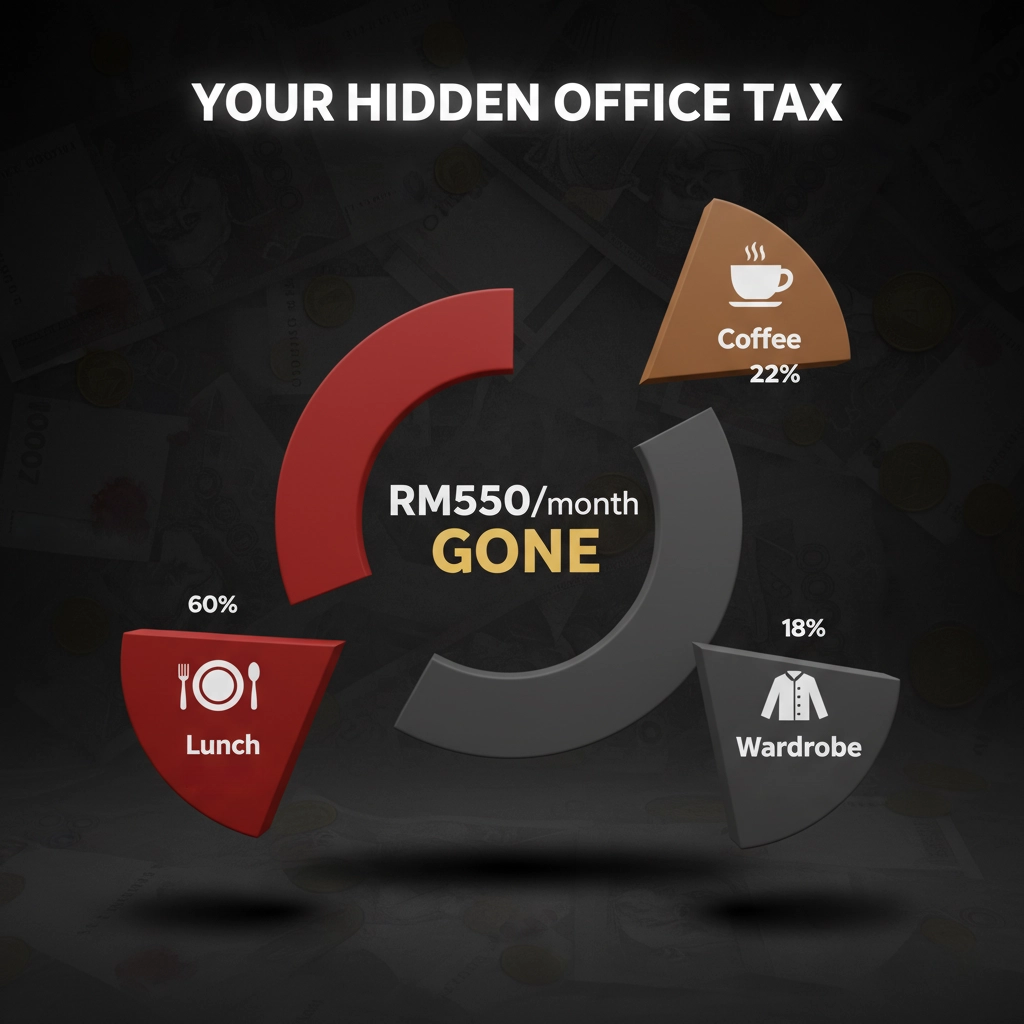

Office Expenses Mid-Range Total:

| Item | Kos Bulanan |

|---|---|

| Lunch | RM330 |

| Coffee | RM120 |

| Wardrobe | RM100 |

| TOTAL | RM550 |

WFH Costs: The Real Numbers

Ramai takut “bill letrik naik gila-gila.” Reality check time.

⚡ Electricity: Not That Scary

Average Malaysian home: 648 kWh/bulan

WFH increase: 15% = ~97 kWh tambahan

With TNB 2025 tariff: RM40-60/bulan increase

Estimated: RM50/bulan

Plus: TNB Energy Efficiency Incentive untuk <1,000 kWh users. Ramai young professionals masih qualify even dengan WFH increase.

Panic cancelled.

🌐 Internet: Already Paying Anyway

Broadband 100-500 Mbps: RM89-149/bulan

Most dah subscribe regardless WFH or not.

Split household cost: RM60/person

🪑 Ergonomic Setup: One-Time Investment

Complete IKEA setup: RM1,000

- Desk + chair + monitor

Amortize 24 months: RM42/bulan

One-time cost. Not recurring nightmare.

WFH Monthly Cost:

| Item | Kos Bulanan |

|---|---|

| Electricity | RM50 |

| Internet | RM60 |

| Equipment | RM42 |

| TOTAL | RM152 |

vs Office mode: RM1,079/bulan

- (commute RM529 + misc RM550)

Savings: RM927/bulan

The True Hourly Rate Formula

Ini calculation yang change everything.

Step 1: Monthly salary - Total costs = Net income

Step 2: Net income ÷ Total hours invested = True hourly rate

Key insight: Office mode total hours = work hours + commute hours

📊 Case Study Breakdown

Junior Professional, RM6,000/month salary

Office Mode (KL, drive, mid-spending):

| Item | Jumlah |

|---|---|

| Salary | RM6,000 |

| Costs | -RM1,079 |

| Net Income | RM4,921 |

| Work hours | 174 |

| Commute hours | +55 |

| Total hours | 229 |

| TRUE RATE | RM21.49/jam |

WFH Mode:

| Item | Jumlah |

|---|---|

| Salary | RM6,000 |

| Costs | -RM152 |

| Net Income | RM5,848 |

| Work hours | 174 |

| Commute hours | 0 |

| Total hours | 174 |

| TRUE RATE | RM33.61/jam |

💡 The Reality Check

Same person. Same job. Same output.

56% difference dalam true hourly rate.

Sebab apa? Location.

Quick City Comparison

Kuala Lumpur:

- Public transport: RM50/bulan

- Car total: RM529/bulan

- Daily commute: 150 min

- Time cost/month: RM1,650

Penang:

- Public transport: RM10 (one-time)

- Car total: RM287/bulan

- Daily commute: 105 min

- Time cost/month: RM1,155

Johor Bahru:

- Public transport: RM50/bulan

- Car total: RM463/bulan

- Daily commute: 90 min

- Time cost/month: RM990

*Time cost calculated @ RM30/hour value

The Strategic Implications

Microsoft Work Trend Index 2025:

Malaysian business leaders embracing AI agents, automation, flexible work structures.

Trend clear: Physical presence makin kurang relevant.

Output > Presence.

Results > Location.

Commute tax dalam era ni? Increasingly unjustifiable.

Calculate Yours: Practical Worksheet

📝 Input Your Numbers:

INCOME:

- Monthly salary: _______

OFFICE MODE COSTS:

- Commute (transport): _______

- Lunch (RM15 x 22): _______

- Coffee: _______

- Wardrobe: _______

- Total: _______

OFFICE HOURS:

- Work: 174 hours

- Commute: _____ hours

- Total: _____ hours

WFH MODE COSTS:

- Electricity: RM50

- Internet (split): RM60

- Equipment: RM42

- Total: RM152

WFH HOURS:

- Work: 174 hours

- Commute: 0

- Total: 174 hours

🧮 Calculate Your True Rates:

Office True Rate:

(Salary - Office costs) ÷ Office hours = _______/jam

WFH True Rate:

(Salary - WFH costs) ÷ 174 hours = _______/jam

Your Difference:

_______%

What This Means For You

💰 Financial Impact

RM927/bulan saved (typical KL scenario)

Annually: RM11,124

5 years invested @ 5% return: RM63,000+

Itu deposit rumah.

Itu emergency fund.

Itu investment portfolio.

⏰ Time Reclaimed

55 jam/bulan commute eliminated.

Annually: 660 hours = 27.5 hari kerja

Use untuk:

- Upskilling courses

- Side business

- Fitness routine

- Family time

- Sleep (underrated)

🎯 Negotiation Power

Armed dengan data ini, job hunting atau performance review?

Argument berubah dari:

“Can I WFH sebab I prefer…”

Kepada:

“Hybrid arrangement optimizes my productivity dan financial efficiency. Here’s the data.”

Bukan minta benefit. Proposal for mutual optimization.

Common Questions Worth Considering

Macam mana kalau company culture need face-time?

Valid concern. Tapi distinguish antara perception dan reality.

Data show: Output-based metrics > presence-based assumptions.

Negotiate trial period. Demonstrate results. Let performance speak.

WFH akan isolate atau tak?

Depends on individual. Some thrive independently. Some need social structure.

Option: Hybrid model. Office 2-3 hari for collaboration. WFH for deep work.

Calculate true rate untuk hybrid. Often optimal middle ground.

Setup cost RM1,000 mahal untuk fresh grad?

Amortize 24 bulan = RM42/bulan.

Compare dengan monthly savings RM927? ROI dalam 1-2 bulan.

Plus: Can start basic. Upgrade gradually. Monitor marketplace for deals.

Bill elektrik really tak naik banyak ke?

TNB data + real case studies confirm: 10-20% increase typical.

For average user 648 kWh baseline, WFH add ~100 kWh = RM40-60.

Not the RM200-300 nightmare people imagine.

Plus Energy Efficiency Incentive threshold helps.

Boss old school, tak approve WFH. Now what?

Document everything. Track your output metrics. Build case over time.

When opportunity arise (performance review, company policy change, new manager), present data-driven proposal.

Meanwhile: Optimize current situation. Minimize commute cost where possible.

Making The Decision

Some people thrive in office. Need social interaction. Productive dalam structured environment.

Ini semua valid.

Tapi decision kena informed, bukan assumption.

Questions To Ask Yourself:

Financial:

True hourly rate office vs WFH - berapa difference untuk your situation?

Time:

Commute hours annually - boleh invest better elsewhere?

Career:

Role perlu physical presence untuk growth? Atau output-based?

Lifestyle:

Current arrangement support long-term goals?

Personal:

Which environment actually make you more productive?

2025 Reality

Old equation: Presence = Productivity

Status: Outdated.

New equation: Output = Value

Status: Current.

Location matters less. Results matter more.

Final Calculation

RM21.49/jam vs RM33.61/jam

Office vs WFH

Same work. Same person.

Which reflects value you want for your time?

Calculate. Analyze. Decide.

Sebab masa dan duit adalah limited resources.

Don’t waste either.

This Is 2025

Work has evolved.

The professionals yang understand true cost? Yang calculate dengan data? Yang negotiate dengan facts?

Mereka yang akan design career strategically. Bukan reactively.

Start Now

Open spreadsheet. Input your numbers. Calculate true rate.

Numbers don’t lie.

True cost per hour untuk your situation?

Let the data speak.

Make informed choice. Not emotional one.

Disclaimer

Artikel ini disediakan untuk tujuan maklumat dan pendidikan sahaja, bukan nasihat kewangan, cukai, atau pekerjaan profesional. Semua data berdasarkan sumber awam dan kajian pasaran 2025, menggunakan anggaran munasabah untuk kos purata. Kadar sebenar (petrol, parking, elektrik, transport) dan situasi individu mungkin berbeza. Pembaca dinasihatkan mengesahkan maklumat terkini dan berunding dengan penasihat profesional (kewangan, cukai, kerjaya) sebelum membuat keputusan penting. Penulis dan penerbit tidak bertanggungjawab terhadap keputusan berdasarkan maklumat ini.

Resources Mentioned:

- TNB electricity calculator & tariff structure (2025)

- My50/Pas Mutiara/myBAS50 transport passes

- Microsoft Work Trend Index 2025 Malaysia insights

- Current petrol rates (Ministry of Finance updates)

For salary benchmarking your specific industry/experience level, check AJobThing Malaysia Salary Guide 2025 atau Tivazo industry reports.

Data based on 2025 rates - petrol, parking, transport passes, electricity tariffs, and salary benchmarks for major Malaysian urban centers.

Calculate yours. Know your worth. Choose wisely.